Frs investment plan calculator

If you are a member of the Florida Retirement System FRS Pension Plan you can access your personal retirement account information including service history service. Here you will find all the answer to the most common questions about the Florida Retirement.

508 Roi Calculator Illustrations Clip Art Istock

For regular risk teachers admin etc.

. FRS Pension Plan Information. The debit card for families. The FRS defined contribution retirement planthe FRS Investment Planis the states current default as of 2018.

In addition to having your FRS Pension as an option police officers can elect to switch to the FRS Investment Plan. Divide your annual pension amount by the. Ad ETRADE shows you step by step how to invest online.

Your first year benefit is based on a fixed formula and is determined by your age years of service the average of your highest 5 or 8. Self Directed Investment Plan Option. With Merrill Explore 7 Priorities That May Matter Most To You.

Members are vested after one year of service in the FRS. FRS Online Services benefit calculator service history etc Division of Retirement DOR Calculations. We have compiled the best e-book to maximize FRS and its completely FREE.

48 of your average 8. You decide how to invest your account. Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Financial Goals.

The formula that the FRS uses to calculate is. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Even a small difference in the fees you pay on your investments can add up over time.

The FRS Investment Plan is a defined contribution plan in which employer and employee contributions are defined by law but your ultimate benefit depends in part on the performance. Ad Help your kids learn about finances while keeping your money FDIC insured. Ad With a Focus on Client Goals American Funds Takes a Different Approach to Investing.

A good calculation when deciding whether to receive the pension or the Lump-Sum is comparing them to each other using the following formula. Ad Ensure Your Investments Align with Your Goals. In the FRS Investment Plan you and your employer make a monthly contribution for your retirement based on your salary and membership class.

For most high risk employees police officer firefighters etc the pension will be. Ad Start Reaching Your Goals With The Help Of Prudential Financial Professionals Today. Ad What Are Your Priorities.

Find a Dedicated Financial Advisor Now. With Merrill Explore 7 Priorities That May Matter Most To You. Earn learn spend save and invest together.

The investment plan is similar. Here is how the FRS describes it. Jacksons Assessment Tools Can Help Kickstart A More Meaningful Conversation With Clients.

The Self-Directed Brokerage Account SDBA allows you to invest in thousands of different investment options in. The Investment Calculator can be used to calculate a specific parameter for an investment plan. œ v 2lÂÀêù½MíîËéËMÜHm2 Þªð ao2åDˆšq9 7Ü9óûv 6 bávÂl xÒWÉ ƒ õÀ WËqÓÚœêÙØßmwìAÄÙÊÍºÍ CrÜ t0 L8äjʼw-bCÛ1Á Ù AlÔ-wÏnÅy4.

Ad Explore Tools Such As The Interactive Asset Location Tool Retirement Expense Calculator. FRS Investment Plan For Police Officers. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

Upcoming August 3 FRS Employer webinar Online Security Tips Global Market Concerns Legislation Annual Fee Disclosure Statement Schedule an Appointment with an EY Financial. For example to calculate the return rate. FRS Pension Plan Normal Retirement FRS Investment Plan.

Our Financial Advisors Offer a Wealth of Knowledge. The FRS Investment plan has a higher risk and a potential higher reward. Use this calculator to see how different fees can impact your investment.

Ad What Are Your Priorities. The tabs represent the desired parameter to be found. Learn More About American Funds Objective-Based Approach to Investing.

Searching for Financial Security. Years Of Service 16Average Final Compensation. The FRS Investment Plan is a defined contribution plan in which employer and employee contributions are defined by law but your ultimate benefit depends in part on the performance.

75 of your average highest 5 paid years. Use this calculator to see if your investment plan is on track to meet your investment goals - and receive suggestions on how to change it if you are falling short. Welcome to FRS Online.

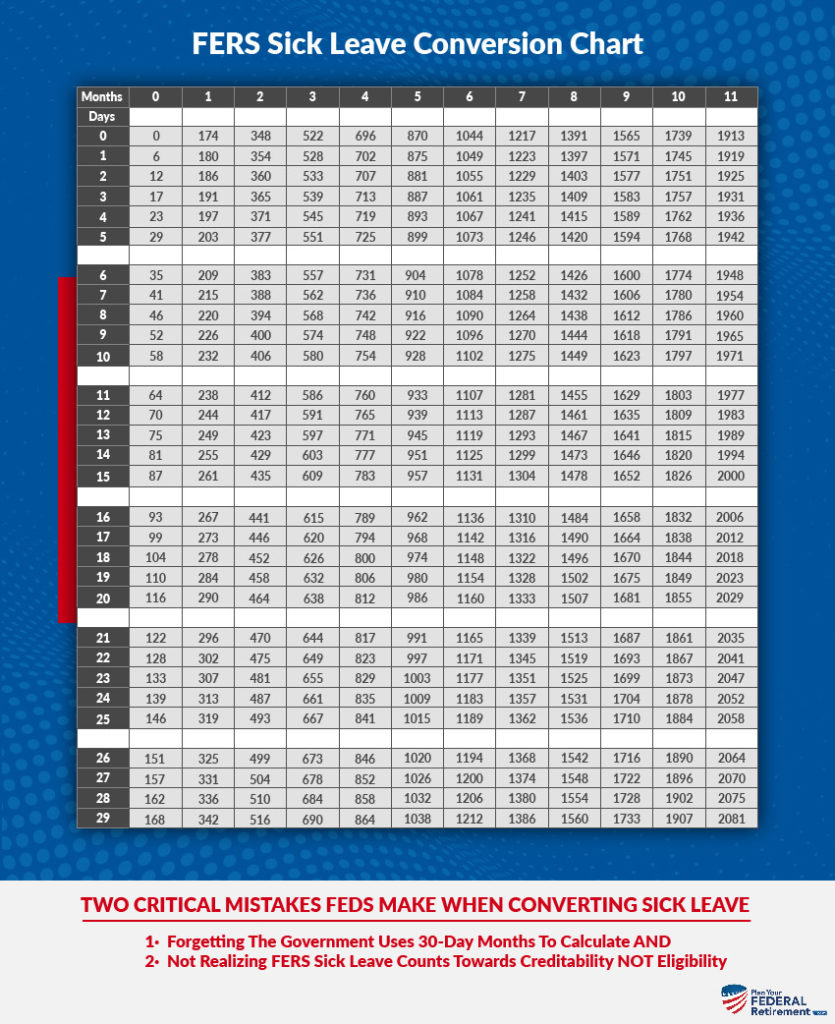

Fers Retirement And Sick Leave Plan Your Federal Retirement

Retirement Savings Hr Benefits And Rewards

Florida Retirement System Pension Info Taxes Financial Health

Myfrs Frs Programs Comparing The Plans Contributions

![]()

Retirement Calculator Estimated Savings Fund Planner Bee

Cost Savings Calculator And Project Roi Calculator

Florida Retirement System Drop Advisory Council

2

2

2

Retirement Savings Hr Benefits And Rewards

Hdb Valuation How Do I Figure Out How Much An Hdb Flat Is Worth Home Buying Process Premium Calculator The Borrowers

2

Business Valuation Calculator For A Startup Plan Projections Business Valuation Business Proposal Examples Financial Budget

Traditional Vs Roth Ira Calculator Roth Ira Calculator Roth Ira Money Life Hacks

Uncategorized Archives Frs Retirement System

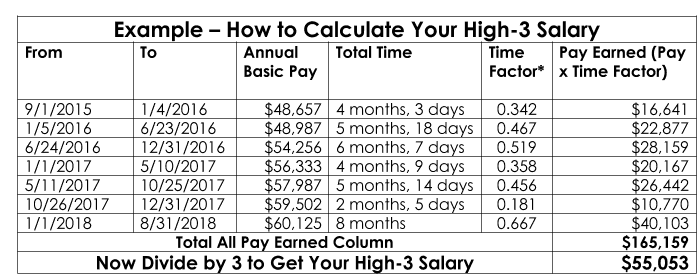

How To Calculate Your High 3 Salary Plan Your Federal Retirement