Effective borrowing cost calculator

How To Grow A Good. The formula to calculate simple interest is.

Cost Of Debt Kd Formula And Calculator Excel Template

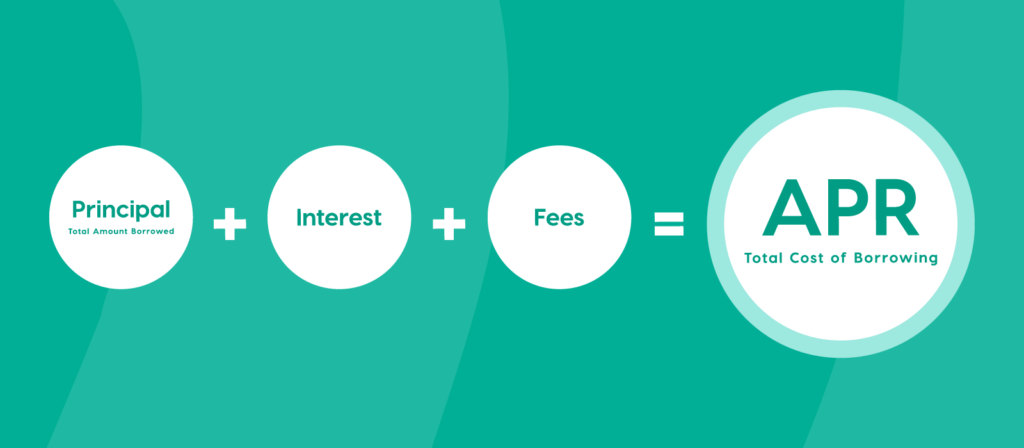

First find the total finance charges by adding all of the interest charged over the life of the loan to other fees.

. How to use our calculator Choose how much you want to save or. For the calculating of the nominal rate to the result need multiply by 12 the term of loan. You can calculate an estimate of effective cost using a fairly simple formula.

Assume that the receivable was due to be. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. Taking an investment loan min.

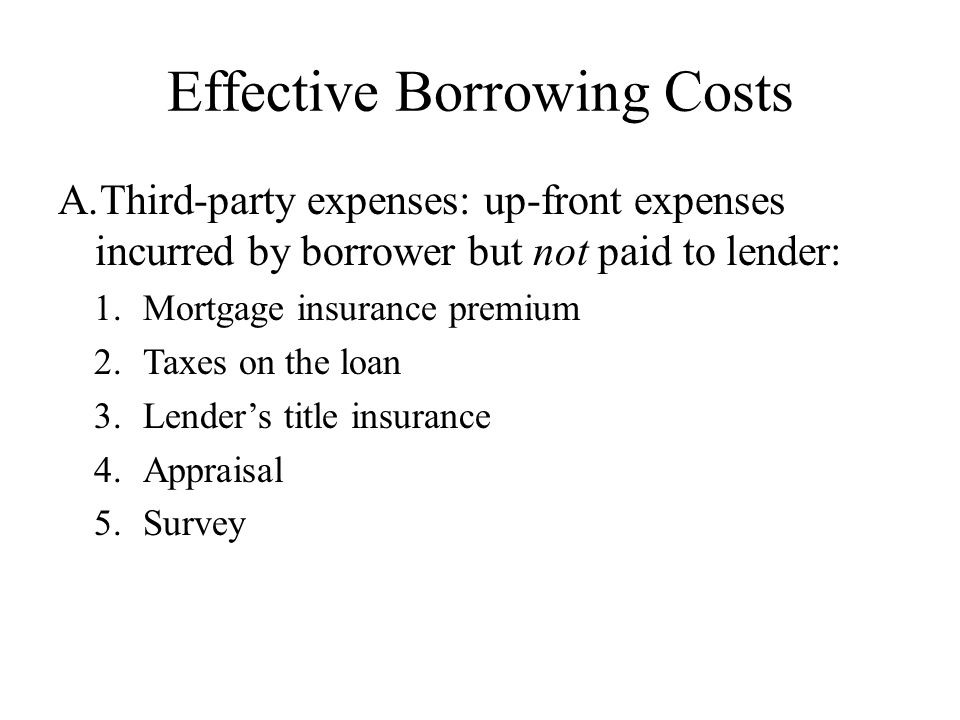

Give some examples of up-front financing costs associated with residential mortgages. There are two basic kinds of consumer. EFFECTIVE COST OF BORROWING Objectives.

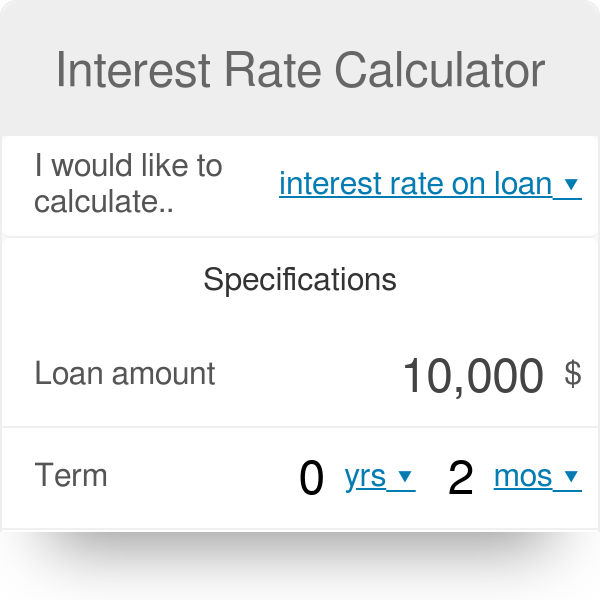

Use this calculator to find out how much a loan will really cost you. 1662 12 1994. Calculate the effective borrowing cost of factoring if a receivable with a face value of 50000 is exchanged for an upfront cash inflow of 49000.

Given the following information calculate the effective borrowing cost EBC. Answer of Given the following information calculate the Effective Borrowing Cost EBC. Use this calculator to find out how much a loan will really cost you.

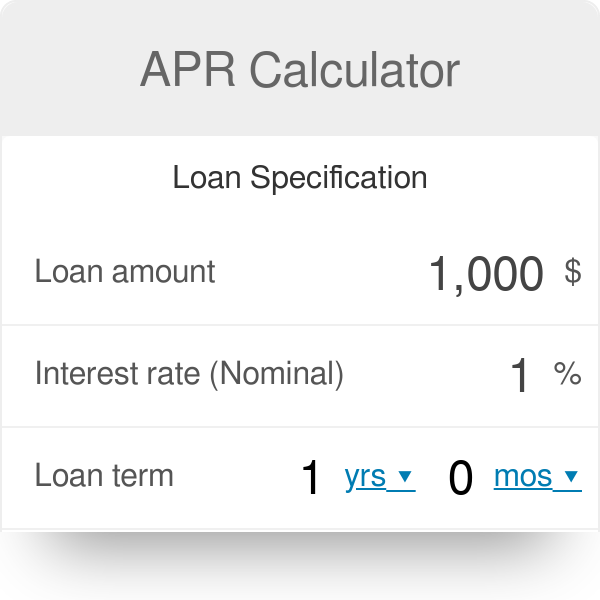

Effective APR Mortgage Calculator This calculator will compute the effective interest rate of a mortgage when upfront loan costs are included. EMI Calculator This EMI Calculator calculates EMI gives a detailed payment schedule with interest and principal breakdown for each EMI and tells you the effective interest rate of loan. Use this calculator to estimate interest deductions and cost of borrowing savings.

For your convenience current Redmond. Get Offers From Top 7 Online Lenders. Ad Need a Business Loan.

When clients borrow money they incur both financial and transaction costs. Financial costs include interest fees forced savings group. The function has given to the effective monthly rate of 16617121.

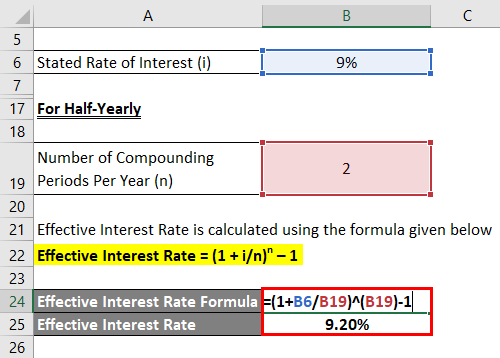

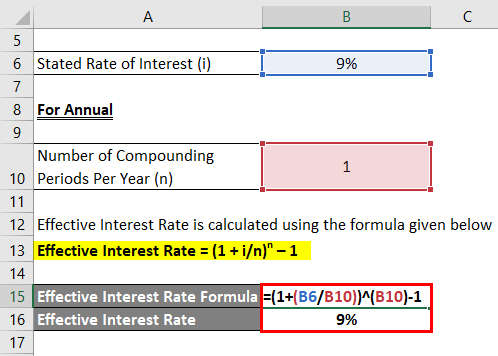

Borrowing and savings calculator Use our interest rate calculator to see how interest rates affect borrowing and saving. Effective Interest Rate is calculated using the formula given below Effective Interest Rate 1 inn 1 Effective Interest Rate 1 102 2 1 Effective Interest Rate 1025 Therefore. What rule can one apply to determine if a settlement closing cost should be included in the.

Do Your Investments Align with Your. Interest Deductibility and Cost of Borrowing Calculator Use this calculator to estimate interest deductions and cost of borrowing savings. Principal x rate x time interest with time being the number of days borrowed divided by the number of days in a year.

If you borrow a 250000. This problem has been solved. Loan Fees and Effective Borrowing Cost Using the same 200000 loan calculate the effective interest rate to the borrowerwhich is yield or internal rate of return IRR to the.

Chapter 15 Mortgage Calculations And Decisions Ppt Video Online Download

Financing Fees Deferred Capitalized And Amortized Types

Pin On Building Credit

/interestrates-28359fec035e44b1a1e52b3a026d3baf.png)

Interest Rates Different Types And What They Mean To Borrowers

Coming Soon Png Transparent Images Just Listed Banner Png Image With Transparent Background Png Free Png Images Transparent Background Earth For Kids Transparent

Effective Interest Rate Formula Calculator With Excel Template

Effective Interest Rate Formula Calculator With Excel Template

Interest Rate Calculator Effective Interest Rate

Here S An Overview Of The Education Loan Process Education Free Education Loan

Chapter 15 Mortgage Calculations And Decisions Ppt Video Online Download

Apr Calculator Annual Percentage Rate

Learn The True Cost Of Borrowing Birchwood Credit

Effective Interest Rate Formula Calculator With Excel Template

Lender S Yield Borrower S Effective Borrowing Costs Apr Youtube

How To Calculate Effective Interest Rate 8 Steps With Pictures

Chapter 15 Mortgage Calculations And Decisions Ppt Video Online Download

Top 10 Tips For Buying An Investment Property Buying Investment Property Investment Property Investing