40 year mortgage calculator with taxes and insurance

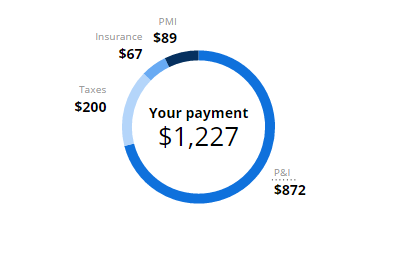

Private mortgage insurance PMI you made a 20 down payment worth 65000. Monthly Taxes Insurance and PMI payment.

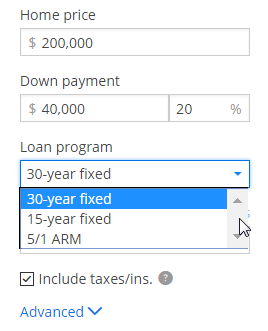

Mortgage Calculator Estimate Your Monthly Payments

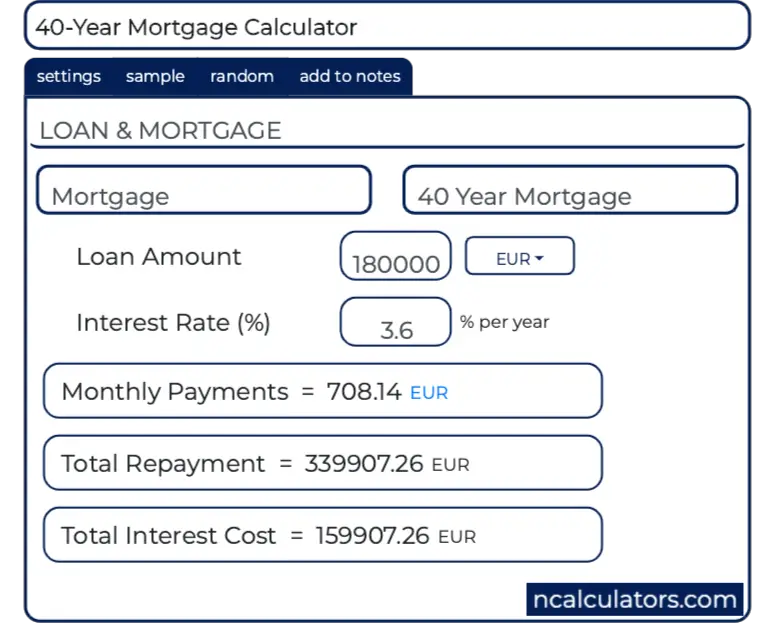

In 2016 and 2017 many younger borrowers across the UK have moved away from using their once-standard 25-year mortgage toward 30 35 even 40-year loan options.

. We also add in the cost of property taxes mortgage insurance and homeowners fees using loan limits and figures based on your location. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more. Our simple mortgage calculator with taxes and insurance makes it easy to calculate your mortgage payment without the headache of performing the tedious math yourselfor worse guesstimating what the payments might be.

Add in taxes insurance and. The calculator below also accounts for other homeownership costs such as real estate taxes homeowners. Includes CMHC insurance land transfer taxes and rates from RBC TD Scotiabank BMO CIBC and HSBC.

Hopeful homeowners have a number of agencies to turn to in California. Making the Choice There are many advantages to choosing a second mortgage loan rather than paying PMI but the ultimate choice depends on your personal financial. Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules.

Use our mortgage calculator to estimate your monthly house payment including principal and interest property taxes and insurance. This calculator will compute a mortgages monthly payment amount based on the principal amount borrowed the length of the loan and the annual interest rate. If you are a Scotiabank mortgage customer depending on the mortgage solution that you select each year you can increase your scheduled monthly payments by up to 10 15 or 20 of the payment initially set for your term or in some cases your current payment and make a lump sum prepayment of up to 10 15 or 20 of your original principal.

Including property taxes homeowners insurance mortgage insurance if applicable and condominium or homeowners association fees. For instance mortgage insurance premium MIP for FHA loans is also cheaper if you choose a 15-year fixed FHA loan. In 2016 the average mortgage term in Sweeden was reported to be 140 years before regulators set a cap at 105 years.

Property taxes home insurance HOA fees and other costs increase with time as a byproduct of inflation. To get an amortization schedule for your 15-year fixed-rate mortgage use the calculator on top of this page. Using our calculator above you can estimate the savings difference conveniently.

How much to put down. The lesser one is your taxes and insurance while the larger one is the principal and interest on its own. A 40-year mortgage extends the mortgage term by 10 years when compared with a traditional 30-year mortgage.

Total monthly mortgage payment. ICB Solutions a division of Neighbors Bank. Homeowners must have mortgage loans insured by CalHFA Mortgage Insurance on or before May 31 2009.

Forbes Advisors Mortgage Calculator uses home price down payment and other loan details to give you an estimate calculation on your monthly mortgage payments. With a second mortgage loan you get to finance the home 100 percent but neither lender is financing more than 80 percent cutting the need for private mortgage insurance. Our Closing Costs Study assumed a 30-year.

The simple rule of thumb I tell buyers is that typically 40 of your monthly payment is taxes insurance mortgage insurance and so on says Jeremy Larsen a Dallas-based real estate agent with 13 years of experience. Depending on the contract other events such as terminal illness or critical illness can. This mortgage calculator makes it easy to see how changes in the mortgage rate or the loan amount affect the income required for a loan.

Check out the webs best free mortgage calculator to save money on your home loan today. The maximum mortgage calculator will allow you to input your monthly obligations your monthly income to calculate the maximum monthly mortgage payment. Most people need a mortgage to finance a home purchase.

To account for there being 52 weeks in a year. A 40-year mortgage with a variable rate Borrowers can get an adjustable-rate mortgage ARM with a 40-year term. 185 percent of your loan amount per year billed monthly.

If you have 15000 to invest you could invest 5000 in each rung. For instance a CD laddering plan of three CDs might have a one-year CD a two-year CD and a three-year CD. When DTI is surging past 40 it could be a sign that you need to increase your income or look for a more affordable.

The mortgage calculator with taxes and insurance allows a borrower to include property taxes and homeowners insurance so that one can get a complete breakdown of the amortization schedule and see how much one has to pay monthly or biweekly. Every little thing adds up such as taxes and fees. While 20 percent is thought of as the standard down.

Head on over to our mortgage qualifying calculator to determine what those amounts will be with different interest rates and loan terms. Use SmartAssets free Pennsylvania mortgage loan calculator to determine your monthly payments including PMI homeowners insurance taxes interest and more. The Mortgage Calculator provides an overview of how much you can expect to pay each month including taxes and insurance.

R - the monthly interest rateSince the quoted yearly percentage rate is not a compounded rate the. The monthly payment formula is based on the annuity formulaThe monthly payment c depends upon. Particularly with first-time buyers the lions share of whom dont have 20 to put down theyre going.

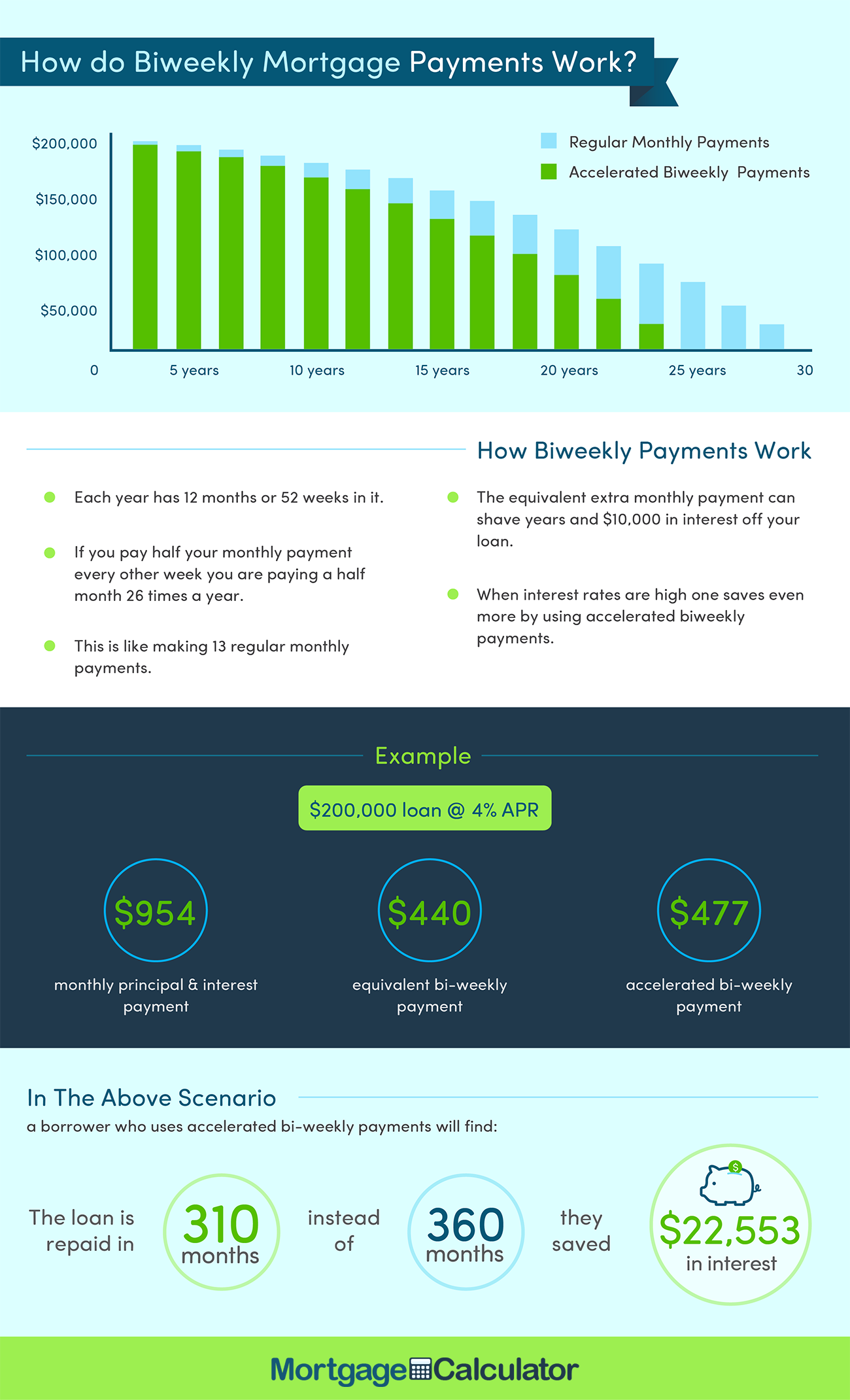

Yes its possible to get a mortgage on 20k a year. Our calculator includes amoritization tables bi-weekly savings. Bi-weekly mortgage payments have two extra payments every year equivalent to one month of mortgage payments over the amount of payments for a monthly or semi-monthly.

The fixed monthly payment for a fixed rate mortgage is the amount paid by the borrower every month that ensures that the loan is paid off in full with interest at the end of its term. Assuming a loan term of 30 years with an interest rate of 5 you may qualify for a home up to 74066 and have a monthly payment of 467. An ARM has a fixed rate for a set time for example five seven or 10 years and then adjusts periodically for the remaining.

Life insurance or life assurance especially in the Commonwealth of Nations is a contract between an insurance policy holder and an insurer or assurer where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person often the policy holder. The California Housing Finance Agency CalHFA has loan programs such the first mortgage conventional or CalPLUS fixed-rate loan down payment assistance programs and mortgage. Not affiliated or endorsed by any govt.

Furthermore compared to a 30-year FRM you save tens and thousands on interest charges with a 15-year FRM. Free mortgage calculator to find monthly payment total home ownership cost and amortization schedule with options for taxes PMI HOA and early payoff. Americans pay about 11 of their propertys value as property tax each year.

To illustrate how bi-weekly payments work lets compare it with monthly payments. 15-year FRMs also come with lower rates by around 025 to 1 than 30-year FRMs. Few homes are built to last 100 years.

Is Dave Ramsey Right About How Much House You Can Afford

Mortgage Calculators

5 Alternative Ways To Use A Mortgage Calculator Zillow

Home Loan Calculators And Tools Hsh Com

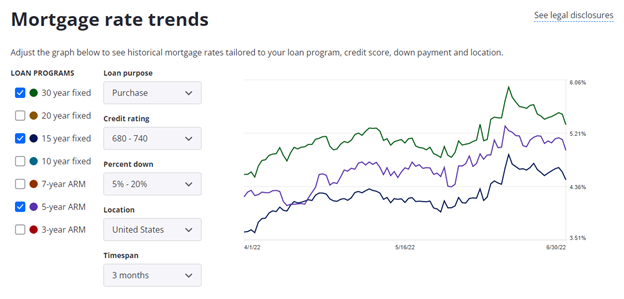

/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

Mortgage Calculator

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

U S Mortgage Calculator Apps On Google Play

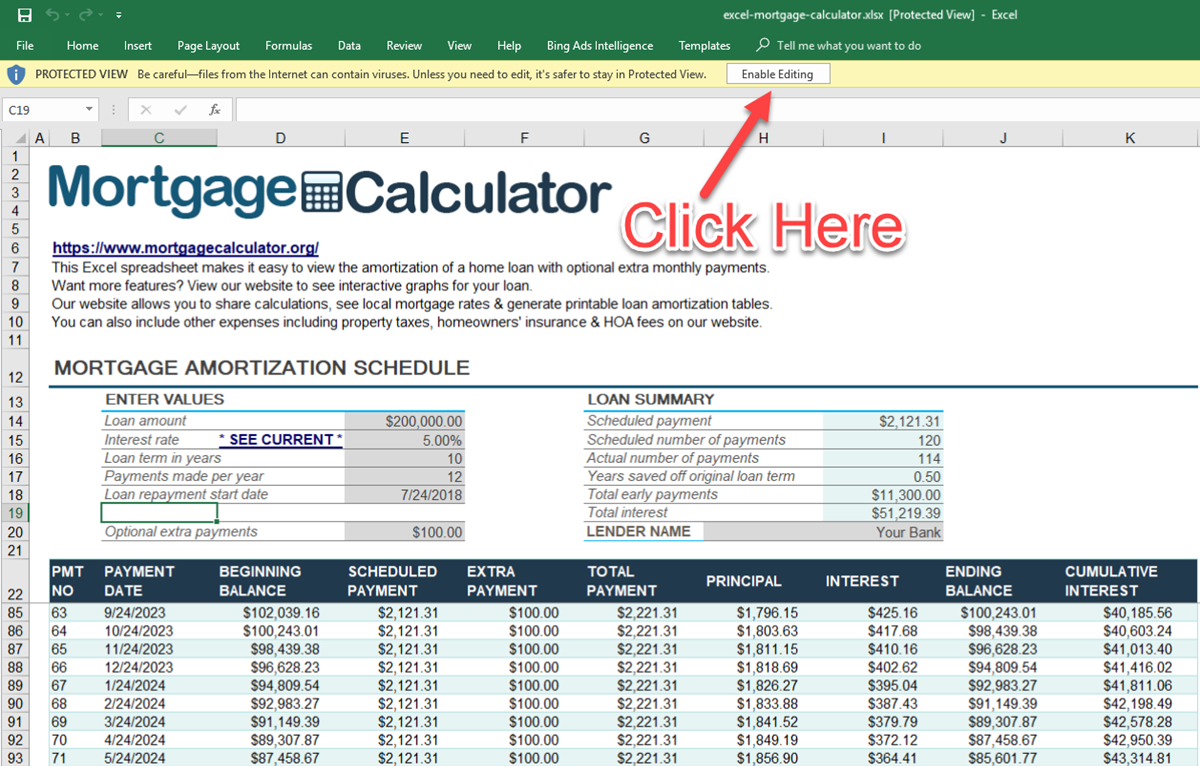

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

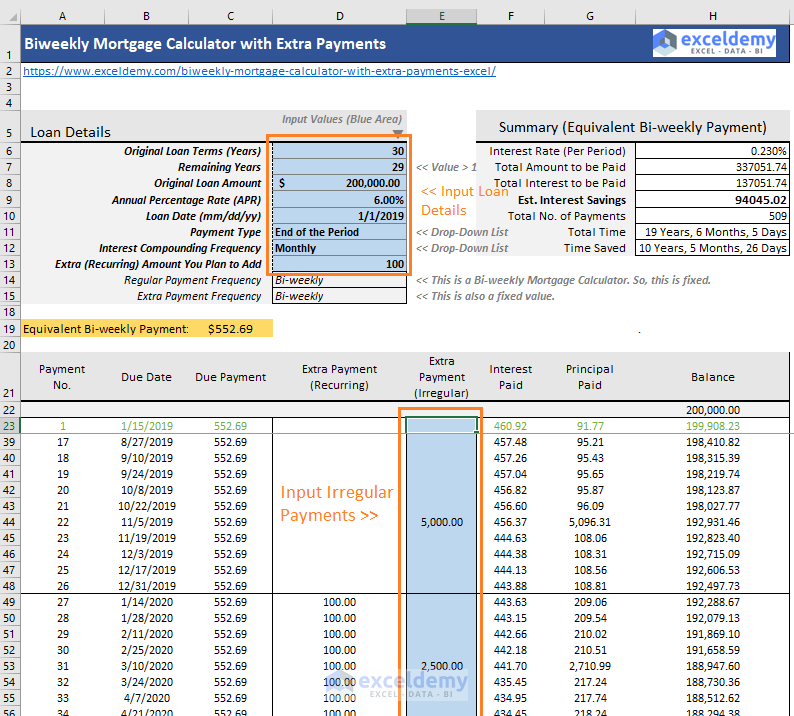

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

5 Alternative Ways To Use A Mortgage Calculator Zillow

Simple Mortgage Calculator Estimate Monthly Payments Moneyunder30

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Mortgage Amortization Calculator Home Equity Loan

40 Year Mortgage Calculator

Mortgage Calculator Moneytips

Mortgage Calculator Estimate Your Monthly Payments

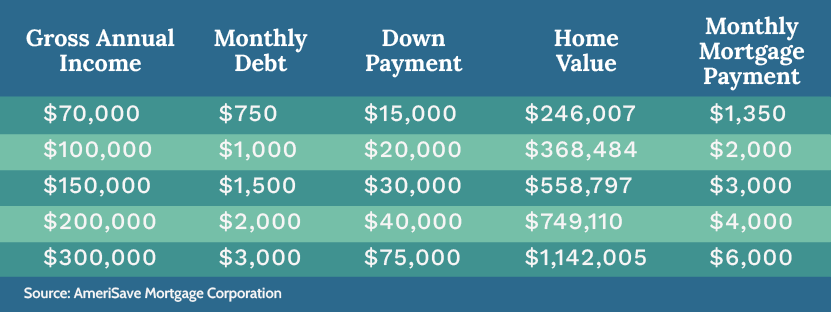

Calculate How Much You Can Afford Home Affordability Amerisave

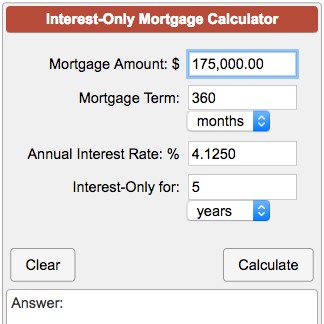

Interest Only Mortgage Calculator